Trump Pharma Tariff Deal-A Turning Point in US-EU Trade

The Trump pharma tariff deal has sent ripples through global markets, marking a dramatic change in trade relations between the United States and the European Union. What started as a threat of crushing 250% tariffs on European pharmaceuticals has now turned into a more manageable 15% rate, leaving both relief and lingering concerns across industries.

For months, European exporters, particularly pharmaceutical giants in Ireland, Denmark, and Germany, braced for devastating tariffs that could have crippled their access to the American market. But under the revised agreement, pharmaceuticals and semiconductors, once excluded, are now included in the 15% tariff framework.

This development highlights how politics, economics, and global health industries intersect, making the Trump pharma tariff deal one of the most important stories in international trade this year.

Trump Pharma Tariff Deal: From Threats to Negotiations

When Donald Trump first announced in April that European exports would face a sweeping 30% tariff, panic spread across the EU. Things escalated further when Trump openly floated the idea of raising pharmaceutical tariffs to 200%, and later up to 250%.

“We want pharmaceuticals made in our country,” Trump told CNBC in early August, fueling fears that Europe’s multi-billion-dollar pharma exports could be severely damaged.

Ireland, home to major US-bound pharmaceutical production, and Denmark, where Novo Nordisk manufactures global bestsellers like Ozempic, were particularly vulnerable. A 250% tariff would have been catastrophic, forcing companies to raise prices dramatically or scale back exports altogether.

Now, thanks to the new deal, the tariffs are capped at 15%, still higher than the original 2.5%, but far from the apocalyptic scenario initially threatened.

How the Trump Pharma Tariff Deal Was Struck

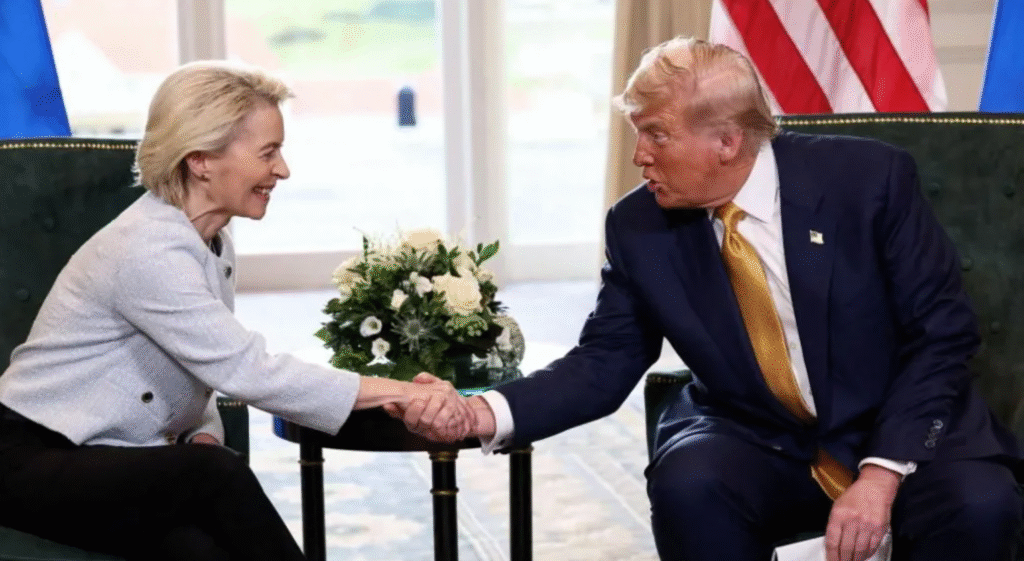

The breakthrough came after intensive negotiations between Trump and European Commission President Ursula von der Leyen in Scotland. The deal was framed as a “first step” that could expand further depending on how both sides implement their commitments.

Under the new agreement:

-

EU exports of pharmaceuticals and semiconductors to the US will face a 15% tariff starting 1 September.

-

US exports of industrial goods, fruits, vegetables, pork, and tree nuts will enter Europe tariff-free.

-

Car tariffs remain the sticking point: Europe must pass legislation cutting US export tariffs to zero before Washington reduces the 27.5% tariff on European cars to 15%.

The European Commission has confirmed it intends to move forward quickly, with EU Trade Commissioner Maros Sefcovic promising to begin the legislative process this month.

Why the Trump Pharma Tariff Deal Matters for Ireland and Europe

Ireland’s Deputy Prime Minister Simon Harris welcomed the inclusion of pharmaceuticals in the deal, calling it “a vital shield” for Irish exporters. Ireland is one of the largest pharmaceutical exporters to the US, and the 250% tariff would have devastated its economy.

For Denmark’s Novo Nordisk and Germany’s Bayer, the deal also provides stability. However, European carmakers remain anxious. Sigrid de Vries, Director General of the European Automobile Manufacturers’ Association, noted that while car tariffs will eventually fall from 27.5% to 15%, they were originally just 2.5%. “The impact will still be huge,” she said, warning of higher prices for US customers.

Trump Pharma Tariff Deal and Its Global Impact

The pharmaceutical industry is deeply tied to global healthcare supply chains. Any major tariff hike affects not just producers and exporters, but also patients worldwide who rely on affordable medication.

According to BBC News, US Secretary of Commerce Howard Lutnick described the deal as creating “historic access” for American producers to Europe’s massive consumer market. Meanwhile, Ursula von der Leyen celebrated the deal as providing “predictability” for both businesses and consumers.

Yet, disappointment remains. Wine and spirits exporters on both sides of the Atlantic failed to secure exemptions. France’s wine exporters federation warned of “major difficulties” ahead, while the US Distilled Spirits Council criticized the lack of a permanent zero-tariff arrangement.

Trump Pharma Tariff Deal: What Comes Next?

While the Trump pharma tariff deal offers immediate relief, it is only a temporary fix. Much depends on how quickly the EU passes legislation to reduce tariffs on American goods. If delays occur, Europe’s car industry will continue to bleed millions of euros each day.

Moreover, this deal sets the stage for further negotiations. Some experts believe wine and spirits will eventually secure exemptions, while others argue Trump may revisit higher pharma tariffs if domestic manufacturing pressures grow.

The global economy is watching closely. With trade tensions already high, any reversal could reignite uncertainty in financial markets.

Conclusion: Trump Pharma Tariff Deal Shows Both Risk and Relief

The Trump pharma tariff deal demonstrates the volatile nature of international trade under high-stakes negotiations. While Europe avoided the worst-case scenario of a 250% tariff, the 15% compromise is still painful for exporters used to near-zero duties.

For now, pharmaceutical exporters breathe easier, but the car industry and spirits sector remain frustrated. As Ursula von der Leyen said, the deal brings “stability”, but whether that stability lasts remains to be seen.