US China Chip Deal Sparks Global AI Trade Shock

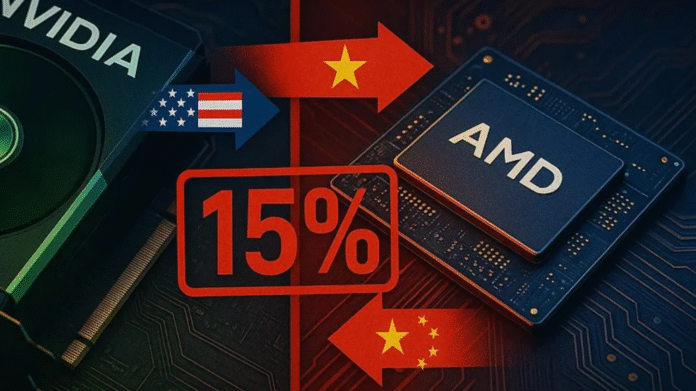

The US China chip deal between Nvidia, AMD, and the US government has sent ripples through the global technology market. In an unprecedented move, both chip giants have agreed to hand over 15% of their revenues from semiconductor sales to China in exchange for export licenses.

This arrangement, aimed at keeping America at the forefront of the artificial intelligence race, also ensures trade ties with China remain intact at least for now.

Nvidia and AMD Strike a Controversial Agreement

According to US officials, the deal allows Nvidia to sell its H20 AI chips and AMD to export its MI308 chips to China under newly granted export licenses. The agreement reportedly came after Nvidia CEO Jensen Huang met with US President Donald Trump at the White House.

The Financial Times first broke the story, revealing that the licenses were approved late last week, though no shipments have been made yet. The finer details of the arrangement remain under wraps, but insiders believe the structure will mirror recent trade agreements.

“We follow rules the US government sets for global markets,” Nvidia said, expressing hope that export control rules will still allow US firms to compete worldwide.

Trump Labels H20 Chips ‘Obsolete’

Despite approving the US China chip deal, President Trump downplayed the significance of the H20 chips, calling them “obsolete.” He claimed China already has similar versions and suggested that Nvidia’s cutting-edge Blackwell chips remain off-limits, unless the company pays the US even more.

Initially, Trump wanted a 20% revenue share from Chinese sales, but negotiations brought it down to 15%. He also hinted that if Nvidia wanted to export a downgraded version of the Blackwell chip, the rate could jump to 30%, 50%.

China Pushes Back on US Chip Exports

The US China chip deal faces resistance from Beijing. State media-linked accounts have raised security concerns, claiming US chips could contain “backdoors” or hidden vulnerabilities.

China’s cybersecurity administration has echoed these fears, questioning potential tracking and shutdown capabilities in the H20 chips. Nvidia strongly denies these allegations, calling such claims unfounded and harmful.

“Embedding backdoors into chips would be a gift to hackers,” the company stated in a blog post last week.

High Stakes in Ongoing US-China Tech Tensions

Technology has become a core battleground in the broader US-China trade rivalry. Both countries are racing for AI supremacy, and advanced chips are a key weapon in that race.

A temporary trade truce that eased tariffs is set to expire soon, but talks in Sweden last month hinted at a possible extension. US Treasury Secretary Scott Bessent described chip export controls as a “negotiating chip” in wider trade discussions.

How the H20 Chip Fits into the Bigger Picture

Nvidia introduced the H20 in 2024 to navigate strict US export rules imposed under the Biden administration, which banned shipping AI chips with higher processing power to China. While the H20 isn’t the company’s most powerful product, it still holds value in the Chinese AI market.

The Trump administration’s approval of its export shows a calculated move: maintain US business dominance in AI without handing over the most advanced capabilities to a rival nation.

China’s Broader Demands in Trade Talks

Reports suggest the US China chip deal isn’t the only tech concession on the table. China is pushing for the US to ease restrictions on high-bandwidth memory (HBM) chips, a critical component for AI performance.

During a press briefing, China’s Foreign Ministry reiterated opposition to what it calls “malicious blockades” and “weaponization” of trade, warning such tactics harm the global supply chain.

Global Implications of the US China Chip Deal

If China accepts the terms, the deal could generate billions in revenue for the US government. But if Beijing follows through on its warnings, Nvidia and AMD could face a significant loss of market access.

Meanwhile, Chinese leaders are doubling down on domestic chip innovation to reduce dependence on US technology a move that could eventually reshape the AI hardware landscape.

For now, the US China chip deal represents both a short-term win for US trade strategy and a long-term gamble in the high-stakes race for AI dominance