Global markets climbed on Wednesday after Nvidia became the first company to reach a $4 trillion value, drawing investor attention away from fresh tariff threats. Asian and European indexes closed higher as traders priced in strong tech performance and a postponed deadline for new U.S. tariffs.

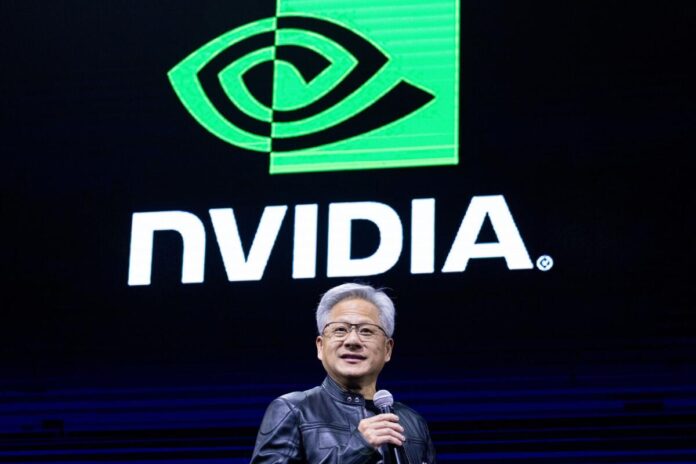

Nvidia Leads Tech Rally to Record Levels

Nvidia shares gained 1.8 percent, briefly trading above $164 before ending at $162.88. The chip maker has seen its stock rise by 88 percent since early April and deliver more than 280 percent returns over two years. Its growth in artificial intelligence computing chips has driven this surge.

Microsoft followed with a 1.4 percent rise, Meta climbed 1.7 percent and Alphabet added 1.3 percent. These moves lifted the Nasdaq Composite to a new peak, while the S&P 500 rose 0.6 percent and the Dow Jones gained 0.5 percent.

Tariff Deadline Pushes Into August

On Tuesday the White House said it would push back the deadline for imposing reciprocal tariffs from July 9 to August 1. Letters went out to 14 trading partners, warning that Japan and South Korea would face 25 percent duties and others could see rates up to 40 percent if they fail to strike new trade deals. This marks the second delay since the April announcement that invoked emergency powers to add a universal 10 percent tariff and threatened higher rates for key partners.

Investors Focus on Fundamentals

Even though U.S. tariff rates have climbed from an average of 2.5 percent to around 15.8 percent as of June, investors have put trade policy worries to one side. They have focused on corporate earnings and growth prospects. Art Hogan, chief market strategist at B Riley Wealth, said Nvidia moved from a gaming chip maker to a top choice for artificial intelligence power. He added this shift helped lift the broader tech sector. Reuters.com

Market Impact and Supply Chain Notes

Trade moves and potential tariffs on semiconductors could affect global supply lines. Companies that rely on chip imports may face higher input costs if talks do not conclude by early August. Yet strong earnings reports and robust demand for AI and cloud services have kept sentiment upbeat. MorningStar.com

Personal Analysis

The market’s response shows how much weight investors place on innovation over policy risk. Nvidia’s milestone underlines that a lead in AI hardware can drive outsized growth even amid uncertain trade relations. That trend may continue if companies push ahead with AI deployment across data centers and edge applications.

However, the risk of further delays or expanded tariffs remains. Traders will watch whether talks yield agreements or simply more extensions. My view is that Nvidia will remain a market bellwether, but broader tech sentiment may wobble if trade tensions flare again.

Sources: Anadolu.com