As President Donald Trump pushes to revive America’s coal industry through sweeping executive orders, his broader economic agenda faces mounting legal challenges that could undermine his fossil fuel ambitions while Congress moves to slash clean energy programs.

The collision of Trump’s coal revival efforts with court battles over his tariff authority and Republican budget cuts to renewable energy highlights the complex tradeoffs at the heart of his second-term energy strategy, creating uncertainty for both traditional and emerging power sectors.

Coal Gets Presidential Boost

Trump signed four executive orders in April aimed at “reinvigorating America’s beautiful clean coal industry,” reclassifying coal as a “mineral” to unlock subsidies and expedite permitting on federal lands. The orders also granted nearly 50 coal plants a two-year exemption from Biden-era Clean Air Act rules requiring reductions in mercury, benzene and other toxic emissions.

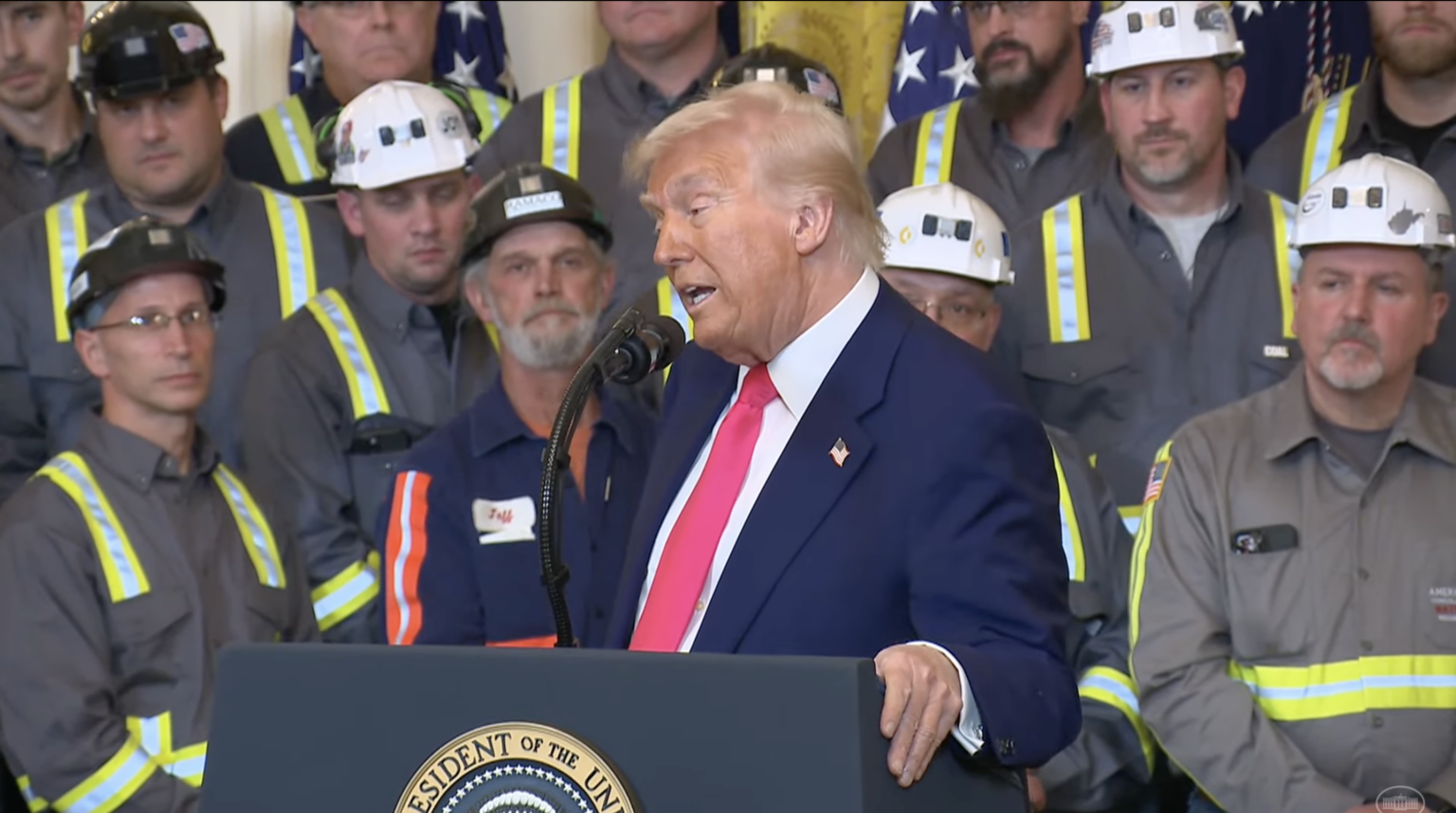

“Coal is essential to our national and economic security,” the White House declared, directing agencies to eliminate policies transitioning away from coal production. Trump promised that shuttered plants would reopen, telling coal workers at a White House ceremony that “all those plants that have been closed are going to be opened”.

The push comes as electricity demand surges from data centers and artificial intelligence, with Trump positioning coal as crucial for powering AI infrastructure.

Courts Challenge Trade Authority

Yet Trump’s broader economic strategy faces judicial scrutiny. The U.S. Court of International Trade ruled May 28 that Trump’s sweeping tariffs exceeded presidential authority under the International Economic Emergency Powers Act. While a federal appeals court temporarily stayed that ruling, the case appears headed to the Supreme Court.

The legal uncertainty creates particular challenges for coal exports. Signal Peak Energy’s Montana mine, which sends 98% of its coal to Japan and South Korea, could see expansion plans threatened if tariffs spark retaliation. “A reaction could conceivably come from Japan and South Korea saying, ‘Well, if you’re going to tariff our shipbuilding or our products, fine, we’re not buying your damn coal,'” said rancher Pat Thiele.

Green Energy Faces Cuts

Meanwhile, House Republicans passed legislation May 22 cutting clean energy tax credits by a 215-214 margin. The bill eliminates subsidies for projects that don’t break ground within 60 days, while Trump’s budget proposes $19.3 billion in cuts to the Department of Energy, including $15 billion from the bipartisan infrastructure law.

Energy analysts warn the coal revival could strand “tens of billions of dollars” in renewable energy investments, with up to 50 gigawatts of coal capacity that would have retired now potentially remaining online.

“As long as they’ve got somebody to buy it, they’ll keep mining,” Thiele observed