Inflation Hits 3.6 Percent in June

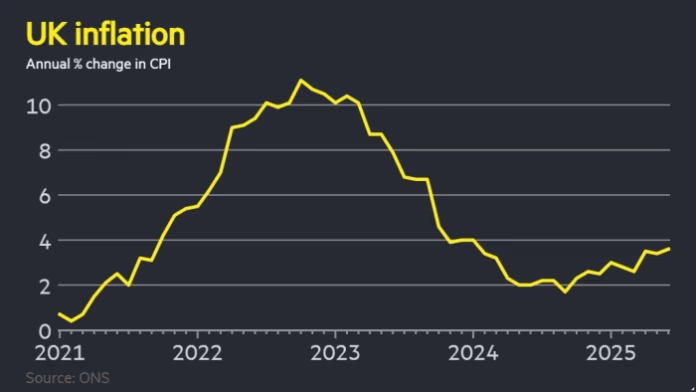

The United Kingdom saw its inflation rate climb to 3.6 percent in June, marking the strongest rise in eighteen months as costs for fuel and groceries edged upward and put pressure on family budgets. Data published by the Office for National Statistics showed that prices rose faster this June than in any month since January 2024, moving up from 3.4 percent in May and beating economist forecasts that had predicted no change.

This unexpected jump sent analysts and investors scrambling to adjust their outlook on future price trends and policy responses.

Transport and Food Costs Drive Prices

Transport costs emerged as a key factor behind the June increase. Prices at the pump fell only slightly, compared with a sharp drop a year earlier, leaving motorists facing higher outlays for fuel. In addition, grocery bills continued to climb as food inflation reached 4.5 percent on an annual basis, the steepest rate since February 2024.

Purchases of everyday staples such as cheese and bakery items proved more expensive, pushing families to spend more on routine shopping trips.

Market Reaction and Bond Yields

Financial markets reacted quickly to the news, with yields on five-year government bonds rising above four percent for the first time since late June 2023. Investors adjusted their expectations for Bank of England policy as they weighed the likelihood of further rate cuts.

Analysts noted that these moves indicated traders now see a lower chance of a near term reduction in borrowing costs. In addition, longer term gilt yields ticked up as investors prepared for a drawn out period of sustained price pressures.

Bank of England Rate Cut Views

The higher inflation number has cast doubt on the Bank of England’s plan to ease monetary conditions in the months ahead. The Monetary Policy Committee reduced its key interest rate twice since the start of the year, moving from 4.75 percent to 4.25 percent. Many experts had counted on a further quarter point cut in August, but markets now place those odds at a much lower level.

Chancellor Rachel Reeves acknowledged that people are still feeling the pinch, and she pledged that her government will work to ease household burdens and deliver measures that will boost spending power.

Personal Analysis

In my view, the spike in inflation this June highlights the fragility of price stability when supply factors shift unexpectedly. Companies and consumers have adjusted to a period of falling costs, and this reversal shows how quickly that balance can change. Looking ahead, the Bank of England faces a dilemma: cutting rates too soon could allow inflation to become entrenched, while holding rates too high for too long could weigh on growth and job creation. I believe that policymakers will need to monitor monthly data very closely and keep communication clear, so households know the reasons behind each decision and can plan accordingly.

Sources: bbc.com