Background on Export Controls

In recent years, the US aimed to curb China’s access to leading AI chips by imposing export controls that restrict the sale of advanced semiconductors. These rules intend to stop Beijing from using American technology in weapons systems.

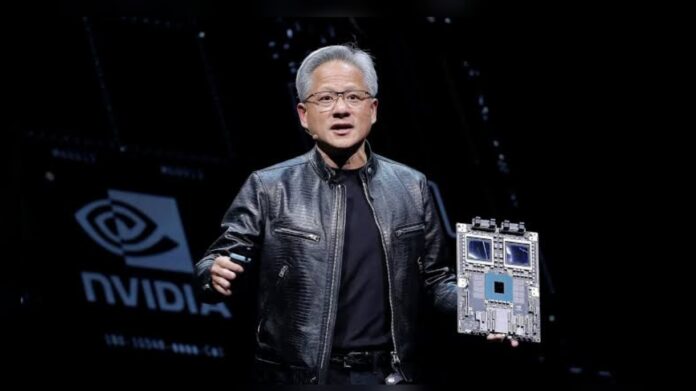

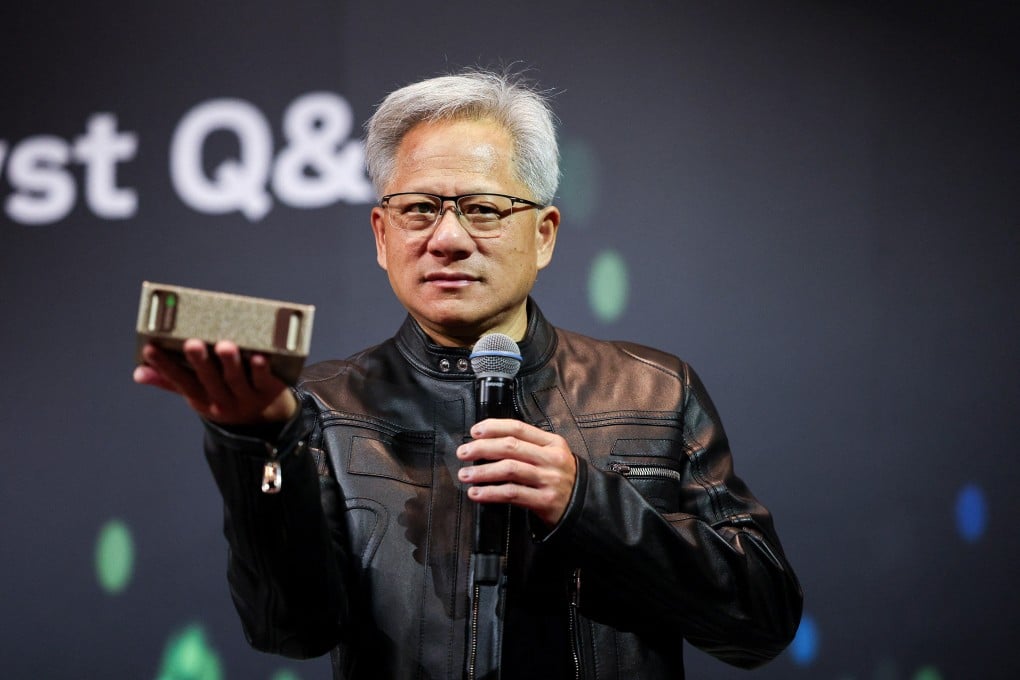

Yet Nvidia Chief Executive Jensen Huang has publicly challenged this view, arguing that China’s military will not rely on US chips because it already holds vast computing resources and fears potential supply cuts.

Huang’s View on China’s Tech Capacity

Huang told CNN that China has built hundreds of supercomputers managed by local engineers and controls abundant server farms. He said Chinese firms operate robust networks of processors and storage gear that serve research labs, universities and defense projects.

He pointed out that Beijing would avoid turning to Nvidia chips if it risked sudden embargoes or sanctions. In his words, “They simply can’t rely on our parts,” emphasizing that risks of a supply halt outweigh any short‑term gain from using US hardware.

Political Responses

US lawmakers reacted swiftly to Huang’s planned trip to Beijing this week. Senators from both parties warned him against meeting firms tied to China’s military or intelligence services. They claimed such talks could legitimize those entities and weaken the impact of export rules.

Meanwhile, the White House has defended its policy as vital to national security. Critics of that stance, including Huang, argue that cutting off exports spurs China to deepen its own research and could speed up homegrown rivals.

Nvidia’s China Strategy

China accounts for roughly 13 percent of Nvidia’s revenue, or about $17 billion in its last fiscal year. Huang’s visits signal a long‑term bet on that market despite escalating trade tensions. In April, he met top officials in Beijing and reiterated that Nvidia plans to expand local partnerships.

During this trip, he will attend a supply chain expo and host a press briefing to underscore the company’s commitment to Chinese customers. At the same time, he balances demands from Washington to uphold export rules that cost Nvidia an estimated $15 billion in sales this quarter.

Impact on the US‑China Tech Race

Huang warned that restricting chip sales could backfire by pushing China to pour more funding into its semiconductor sector. He recalled how China once limited export of rare minerals to the US and watched American firms race to develop domestic substitutes.

He argued that a similar push in chip design would erode America’s lead over time and produce competitors that operate outside US influence. His view reframes the policy debate by suggesting that openness can sometimes slow down rivals more than barriers do.

Personal Analysis

The Nvidia chief makes a strong point when he notes that China already deploys vast computing assets and has incentives to build local chip capacity. Yet his stance overlooks that cutting‑edge AI workloads often rely on very latest microarchitecture and software optimizations that US firms lead.

If Beijing cannot buy those parts, its progress may slow. On the other hand, export controls could provoke Beijing to invest even more, making future competition fiercer. In that sense, Huang’s warnings highlight a dilemma: strict controls may provide short term gains but risk accelerating China’s self‑sufficiency over the long run.

Sources: CNN.com