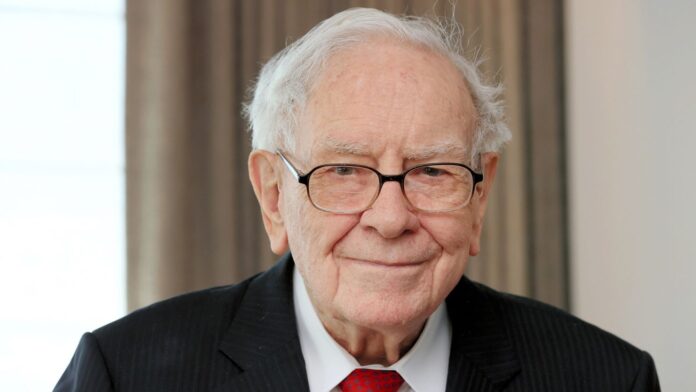

Warren Buffett, the 94‑year‑old investor known as the “Oracle of Omaha,” made his largest annual charitable gift on Monday by transferring about $6 billion in Berkshire Hathaway Class B shares to five foundations, with the Bill & Melinda Gates Foundation Trust receiving the lion’s share of $4.6 billion. This contribution raises his total lifetime donations to these groups to more than $60 billion since he began systematic giving in 2006 investopedia.comhoustonchronicle.com.

Details of the Donation

To facilitate the gift, Buffett converted 8,239 Class A shares into 12.36 million Class B shares, which are easier for charities to manage and cash out. Of those, 9.43 million shares went to the Gates Foundation Trust, while 943,384 shares were allocated to the Susan Thompson Buffett Foundation, named in honor of Buffett’s late wife. The remaining 660,366 shares each were split among three family‑led foundations: the Howard G. Buffett Foundation, Sherwood Foundation, and NoVo Foundation e.vnexpress.net.

Succession and Corporate Context

Buffett’s gift comes as he plans to step down as Berkshire Hathaway’s CEO by the end of the year, paving the way for Vice Chair Greg Abel to take the helm. In May, Buffett announced the transition, which briefly sent Berkshire’s stock down nearly 6 percent. Despite giving away tens of billions, he still controls the company through Class A shares, owning about 13.8 percent of the company—valued at roughly $145 billion investopedia.comhoustonchronicle.com.

Buffett’s Philanthropic Legacy

Buffett pledged in 2006 to donate 99.5 percent of his fortune, and he co‑founded the Giving Pledge with Bill Gates in 2010 to encourage other billionaires to commit at least half their wealth to charity. His systematic approach means annual contributions that roughly match or exceed the previous year’s gift, putting pressure on recipient organizations to distribute funds efficiently. Over nearly two decades, his donations have surpassed the GDP of more than half the nations tracked by the World Bank investopedia.come.vnexpress.net.

Short Analysis

It’s striking to see Buffett stick to his methodical plan even as his net worth and influence grow. By funneling such a huge gift into established foundations, he signals confidence in their ability to deploy capital well, rather than chasing smaller, trend‑driven causes. This move also highlights a tension in modern philanthropy: while mega‑gifts can drive large-scale impact, they can create dependency on one individual’s vision and timetable. As Buffett passes the CEO torch, his giving strategy offers a model of disciplined generosity, but it also raises questions about how charities will sustain momentum once the steady flow of Berkshire shares ends.