Treasury Secretary Scott Bessent accused California Governor Gavin Newsom on Sunday of crossing a legal line by suggesting the state could withhold federal tax payments. In a post on X, Bessent wrote that Newsom’s statement “amounts to a threat to commit criminal tax evasion” and reminded state officials that federal law assigns personal liability to anyone who tries to evade or defeat taxes. The secretary urged California businesses and payroll managers to continue sending the money they owe to the U.S. Treasury, noting that “most California businesses know that failing to pay taxes owed to the Treasury constitutes tax evasion and have no intention of following the dangerous path Governor Newsom is threatening.”

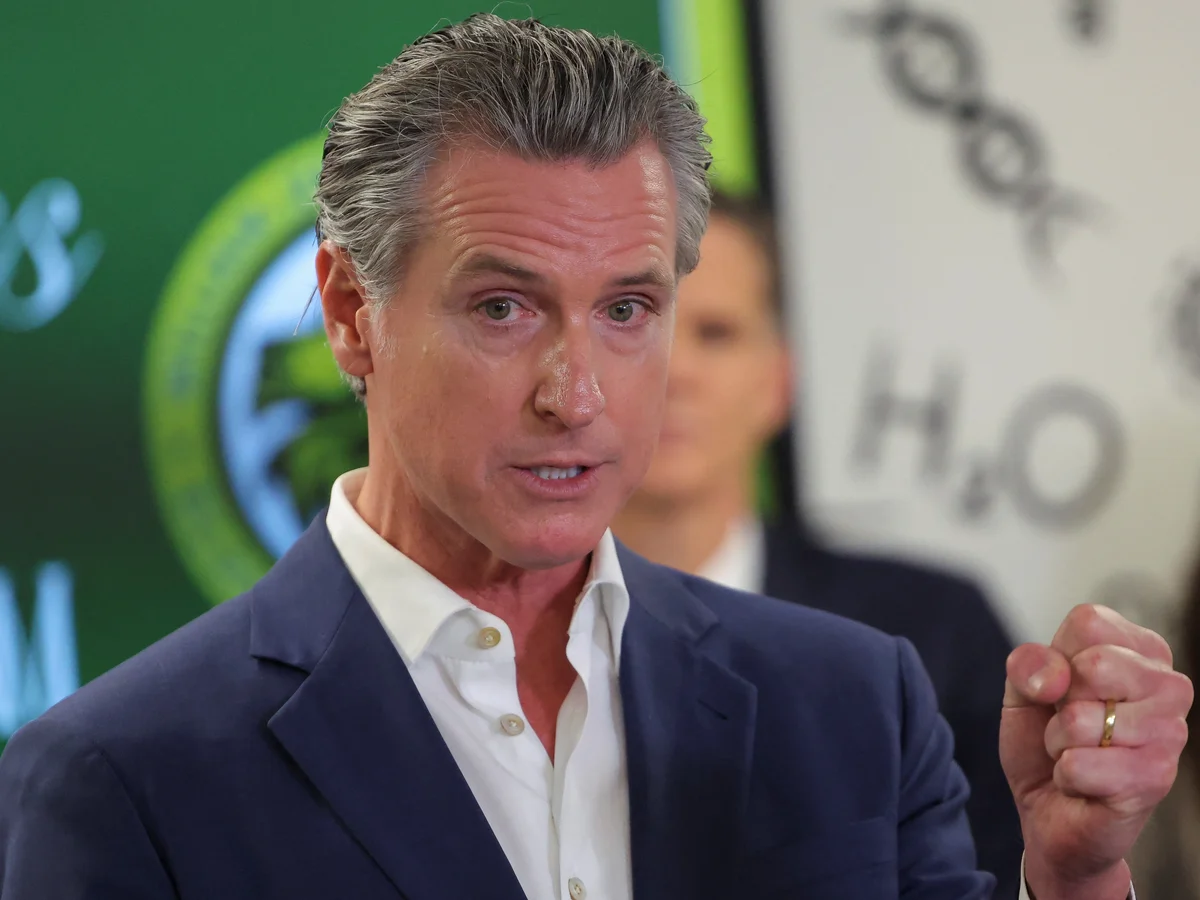

Newsom’s remarks came after reports that the Trump administration might cut off federal grants to the University of California and California State University systems. The governor pointed out that California sends about eightythree billion dollars more in federal taxes than it receives back and suggested on Friday that the state might stop making those payments as leverage. “Californians pay the bills for the federal government,” he wrote. “We pay over eighty billion more in taxes than we get back. Maybe it is time to cut that off.” His post followed President Trump’s threat to impose “large scale fines” on California after a transgender athlete assigned male at birth won titles in girls’ track events.

Political leaders in Sacramento backed the idea, too. Assembly Speaker Robert Rivas and State Senate Pro Tem Mike McGuire said they would explore legal and fiscal options if the federal government moved to revoke grant money. Their comments came amid growing tension over the rights of transgender athletes and over the administration’s hard line on sanctuary policies and other areas where California’s approach differs sharply from federal directives. The dispute has become a flashpoint in a broader fight over states’ rights and federal power.

In his post, Bessent made clear that the law treats willful tax evasion as a felony and that any state officer who authorizes withholding could face criminal charges and personal fines. He pointed out that California tried a similar move in 2017 when the state legislature considered a tax credit scheme aimed at reducing payments to the federal government. Federal officials then warned that any plan to divert tax revenue would violate clear legal prohibitions. “Instead of committing criminal tax evasion,” Bessent wrote, “Governor Newsom should consider a tax plan for California that follows the Trump Tax Cuts model.”

The White House also weighed in on the dispute. A spokesman dismissed the likelihood of widespread grant terminations but criticized California’s policies on energy, crime, and immigration as out of step with national interests. Federal agencies have begun reviewing which grants and contracts they could choose to end under the president’s executive order on gender participation in sports. That order bars biological males from competing in women’s events in federally funded programs. Should those reviews result in cuts, California’s universities could lose hundreds of millions of dollars in research and student aid.

Legal experts say the standoff raises novel questions about the limits of state power. They note that while a state can protest federal policy, it cannot unilaterally withhold funds that belong to the United States. Any attempt to do so would trigger a court fight, and courts have consistently upheld Congress’s authority to set tax rules. California faces a choice between escalating the dispute or seeking relief through the federal courts. For now, the governor’s office has not backed down, and the Treasury Department has signaled it will enforce the law to the fullest. As both sides prepare for a legal battle, California businesses and taxpayers will watch closely to see whether political posturing could spill over into their bottom lines.